All Categories

Featured

Table of Contents

Trustees can be family participants, relied on people, or banks, relying on your choices and the intricacy of the depend on. You'll need to. Properties can consist of cash money, property, stocks, or bonds. The goal is to make certain that the trust fund is well-funded to fulfill the child's long-lasting economic requirements.

The function of a in a youngster assistance depend on can not be underrated. The trustee is the individual or organization accountable for taking care of the depend on's possessions and making certain that funds are dispersed according to the terms of the depend on agreement. This includes making certain that funds are used solely for the youngster's advantage whether that's for education, healthcare, or day-to-day costs.

They should additionally supply regular reports to the court, the custodial parent, or both, depending upon the regards to the depend on. This liability guarantees that the count on is being taken care of in a way that benefits the child, protecting against abuse of the funds. The trustee also has a fiduciary task, indicating they are legitimately bound to act in the very best interest of the youngster.

By acquiring an annuity, moms and dads can ensure that a taken care of amount is paid regularly, no matter any variations in their earnings. This supplies assurance, recognizing that the kid's demands will certainly remain to be met, despite the monetary scenarios. Among the key benefits of using annuities for youngster support is that they can bypass the probate procedure.

Is there a budget-friendly Deferred Annuities option?

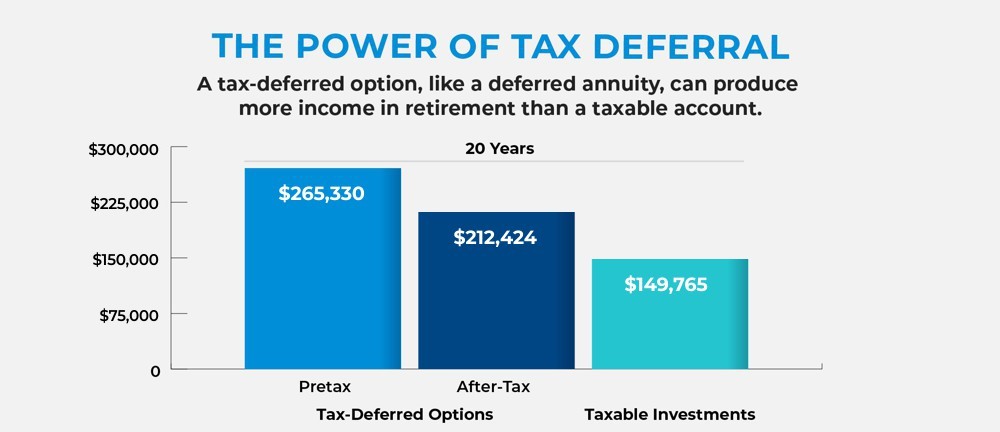

Annuities can also offer defense from market variations, ensuring that the youngster's financial backing continues to be stable even in unpredictable financial conditions. Annuities for Kid Support: A Structured Option When establishing, it's important to consider the tax obligation effects for both the paying moms and dad and the child. Trust funds, depending on their framework, can have different tax treatments.

In various other cases, the beneficiary the kid might be accountable for paying tax obligations on any kind of distributions they obtain. can also have tax obligation ramifications. While annuities offer a stable income stream, it is essential to recognize exactly how that earnings will be tired. Relying on the framework of the annuity, payments to the custodial moms and dad or child may be considered taxed income.

One of one of the most substantial benefits of using is the ability to safeguard a youngster's economic future. Trust funds, specifically, supply a level of protection from creditors and can ensure that funds are utilized properly. For circumstances, a count on can be structured to make sure that funds are just utilized for particular objectives, such as education and learning or medical care, stopping abuse - Annuity riders.

What should I know before buying an Retirement Annuities?

No, a Texas youngster assistance count on is especially developed to cover the youngster's crucial requirements, such as education and learning, health care, and daily living costs. The trustee is legally bound to make certain that the funds are made use of exclusively for the advantage of the kid as laid out in the count on arrangement. An annuity offers structured, foreseeable repayments in time, making certain consistent financial backing for the youngster.

Yes, both kid support trusts and annuities come with potential tax ramifications. Depend on income might be taxed, and annuity repayments can likewise go through taxes, relying on their framework. It is essential to talk to a tax professional or financial expert to understand the tax obligation obligations connected with these financial devices.

Why is an Tax-efficient Annuities important for long-term income?

Download this PDF - View all Publications The elderly person population is huge, expanding, and by some estimates, hold two-thirds of the private wealth in the United States. By the year 2050, the variety of seniors is projected to be nearly twice as huge as it was in 2012. Given that many elders have been able to conserve up a savings for their retired life years, they are usually targeted with fraudulence in a manner that more youthful individuals with no savings are not.

In this environment, customers need to arm themselves with info to safeguard their passions. The Chief law officer supplies the following suggestions to take into consideration prior to acquiring an annuity: Annuities are difficult investments. Some bear complicated high qualities of both insurance policy and safeties products. Annuities can be structured as variable annuities, repaired annuities, prompt annuities, delayed annuities, and so on.

Consumers need to review and understand the syllabus, and the volatility of each investment listed in the prospectus. Financiers must ask their broker to discuss all conditions in the syllabus, and ask inquiries about anything they do not recognize. Dealt with annuity products might likewise lug risks, such as long-term deferral durations, disallowing financiers from accessing every one of their cash.

The Attorney General has actually filed lawsuits against insurance provider that offered unsuitable delayed annuities with over 15 year deferral periods to investors not anticipated to live that long, or that require access to their money for wellness care or helped living expenditures (Annuities). Financiers should make certain they recognize the long-lasting repercussions of any annuity acquisition

What types of Fixed Annuities are available?

The most substantial fee linked with annuities is often the abandonment cost. This is the portion that a consumer is charged if he or she withdraws funds early.

Consumers might want to speak with a tax specialist before spending in an annuity. The "safety and security" of the financial investment depends on the annuity.

Agents and insurance provider might supply bonuses to tempt financiers, such as added passion points on their return. The advantages of such "perks" are typically surpassed by raised fees and management expenses to the capitalist. "Bonus offers" might be just marketing gimmicks. Some underhanded representatives encourage consumers to make impractical investments they can not manage, or acquire a lasting deferred annuity, despite the fact that they will certainly need accessibility to their money for health treatment or living costs.

This section provides info helpful to retired people and their households. There are lots of events that could influence your advantages.

How much does an Lifetime Income Annuities pay annually?

Key Takeaways The recipient of an annuity is an individual or company the annuity's owner marks to obtain the agreement's fatality advantage. Various annuities pay to recipients in various ways. Some annuities might pay the recipient consistent repayments after the agreement owner's death, while various other annuities may pay a death advantage as a round figure.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Pros and Cons of Deferred Annuity Vs Variable Annuity Why Fi

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Features of Fixed Vs Variable Annuity Pros Cons Why Fixed Vs Va

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies What Is Variable Vs Fixed Annuities? Benefits of Fixed Vs Variable Annuity Pros And Cons Why Pros And Con

More

Latest Posts